Retroactive cover date

The medical indemnity insurance cover offered to MIPS members is a claims-made insurance policy. Retroactive cover ensures that you have

continuous cover for claims which you are currently unaware of that might arise from health care services provided by you in previous years. If you

do not nominate retroactive cover you will not be provided indemnity for any incidents that may arise from health care services provided by you

prior to the start date of your MIPS membership period. Please note, MIPS may choose not to accept a retroactive cover date prior to 1 July 2000.

Australian law requires all medical indemnity insurance cover to be provided on a 'claims-made' basis. As such, all providers, including MIPS, offer retroactive cover.

Retroactive cover is cover, in compliance with legislative requirements, for potential claims arising from health care services provided by you

previously where you are unaware of such claims or incidents likely to give rise to a claim at the time of obtaining cover under a policy and at any

renewal and for which you do not otherwise have cover. Under the policy, MIPS Insurance will indemnify you for any previously unknown or

unreported claim made against you during the period of insurance and notified to us in the period of insurance if the claim arises from a health care

incident occurring in the period between the retroactive date and the first day of the period of insurance of which you were previously unaware.

Your Member’s Benefit Statement will show if you have retroactive cover.

Example of cover

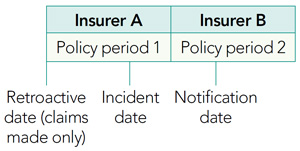

This diagram illustrates a claim under both claims incurred and claims made. MIPS indemnity cover is claims made.

- If the policies were claims-made then the incident would be covered by Insurer B because the incident was first notified in period 2 and occurred after the retroactive date. This is how MIPS' cover works.

- If the policies were claims incurred then the incident would be covered by Insurer A because the incident occurred within the period covered by Insurer A.

Your Membership Fee

Fee changes from 1 July 2024

As the demands of healthcare become more complex, the risk landscape also evolves, and this directly impacts medical indemnity insurance in Australia.

At MIPS, we have experienced a significant increase in the number of claims over the last three years, most notably from patient complaints, regulatory inquires, and coronial matters.

With the rising number of claims, we have invested in our operations to ensure we continue to provide comprehensive support for all our members as they face the demands and challenges of healthcare.

This investment includes increasing the number of our Medico-Legal Advisors and enhancing our systems and technology.

As a member-owned, not-for-profit organisation, we strive to keep membership fees affordable. However, due to the costs associated with an increase in claims and new rating factors, your fees may have changed this year.

We recognise that the fee increase may be substantial for some members, and we also appreciate that over recent years there have been successive fee increases. We have taken steps at MIPS to ensure that we contain the increase as much as possible, but fundamentally, it is both necessary and important that we make these changes for 2024-25.

How we calculate your individual membership fee

We use a primarily risk-based approach to calculate membership fees and work hard to keep them as low as possible. Your individual membership fee is based on your membership details, which means your fee responds to how your practice changes over time.

This year, MIPS has introduced new rating factors in the calculation of membership fees. Factors such as previous claims and sex will now be considered. This change will ensure fairer and more equitable membership fees that better reflect a member’s individual risk profile.

Your Member Benefit Statement includes your individual membership details for the current and three prior membership periods. The factors we consider in our calculation are:

- Your category (e.g. General surgery; Dentist; Psychiatry)

- Your practice basis (e.g. Employer indemnified; Recent graduate)

- Your estimated annual gross billings and/or salary or hours for practice that is not employer indemnified

- Whether your type of practice requires an endorsement (e.g. Minor cosmetic services; Spinal surgery; Bariatric surgery)

- The state/territory you practise in

- Your retroactive cover date

- Your claims history

- Your sex

- Any specific factors that impact your risk.

- Any loadings including a risk surcharge. If applicable, the risk surcharge will be included in accordance with the Medical Indemnity Act 2002 (Cth).

We calculate your membership individually based on the information you provide. This approach ensures your fee reflects the contribution required to appropriately support and cover the risk to indemnify you. As your practice changes and develops, so does your membership fee. If you have recently commenced practice that is not indemnified by your employer (or moved to a higher risk practice classification), your membership fee may change.

Does MIPS ‘price match’ or discount?

As a not-for-profit we believe that our risk assessment approach leads to member being charged a fair membership fee.

On this basis, we do not engage in price matching or discounting. We charge what we have calculated as the appropriate contribution required to cover your member benefits including the risk arising from both current and past practice.

We recommend you contact MIPS to ensure your membership classification is appropriate for the practice you undertake. Any adjustments to your current or past practice details may result in an adjustment to your membership fee.

If you need to request a revised quote or require any assistance, contact MIPS on 1300 698 574 or info@mips.com.au.

Government support with fees

You may be eligible for the Australian Government’s Premium Support Scheme (PSS), which is designed to help eligible doctors with the costs of their medical indemnity insurance. For more details, visit our PSS page here.

The Australian Government also offers a Run-off Cover Scheme (ROCS) – see more information about this at the ROCS FAQ at health.gov.au or on our ROCS page here.

How to pay your membership fee

Your membership fee can be paid in full by the due date, or in 10 monthly direct debit instalments. To opt in for direct debit, complete the Direct Debit Instalment Request at mips.com.au/forms

Professional indemnity insurance is underwritten by MIPS Insurance Pty Limited, which is a wholly owned subsidiary of Medical Indemnity Protection Society (MIPS) and the policy is held on trust by MIPS for the benefit of its members. The information provided here is general advice only. You should consider the appropriateness of the advice having regard to your objectives, financial situation, and needs before taking any action. Please read the Member Handbook, available at

www.mips.com.au.