Retroactive cover date

The medical indemnity insurance cover offered to MIPS members is a claims-made insurance policy. Retroactive cover ensures that you have

continuous cover for claims which you are currently unaware of that might arise from health care services provided by you in previous years. If you

do not nominate retroactive cover you will not be provided indemnity for any incidents that may arise from health care services provided by you

prior to the start date of your MIPS membership period. Please note, MIPS may choose not to accept a retroactive cover date prior to 1 July 2000.

Australian law requires all medical indemnity insurance cover to be provided on a 'claims-made' basis. As such, all providers, including MIPS, offer retroactive cover.

Retroactive cover is cover, in compliance with legislative requirements, for potential claims arising from health care services provided by you

previously where you are unaware of such claims or incidents likely to give rise to a claim at the time of obtaining cover under a policy and at any

renewal and for which you do not otherwise have cover. Under the policy, MIPS Insurance will indemnify you for any previously unknown or

unreported claim made against you during the period of insurance and notified to us in the period of insurance if the claim arises from a health care

incident occurring in the period between the retroactive date and the first day of the period of insurance of which you were previously unaware.

Your Member’s Benefit Statement will show if you have retroactive cover.

Example of cover

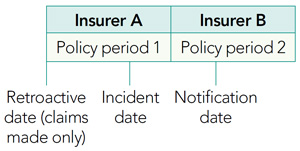

This diagram illustrates a claim under both claims incurred and claims made. MIPS indemnity cover is claims made.

- If the policies were claims-made then the incident would be covered by Insurer B because the incident was first notified in period 2 and occurred after the retroactive date. This is how MIPS' cover works.

- If the policies were claims incurred then the incident would be covered by Insurer A because the incident occurred within the period covered by Insurer A.

Insurance cover is subject to the terms, conditions, and exclusions of the policy. The information provided is general advice only and does not consider your personal circumstances or needs. You should review the Member Handbook Combined PDS and FSG and/or contact MIPS on 1800 061 113, before making a decision. Information is current as at the date published.

Your Membership fee

Fee changes from 1 July 2023

In response to the rise in the cost of providing member protection, support, and advice across the industry, we have updated our fee structure this year. As a result, individual membership fees may have changed.

Please email our Member Services team at info@mips.com.au if you would like to discuss your Member Benefit Statement.

How we calculate your individual membership fee

As a member-owned not-for-profit organisation, we use a primarily risk-based approach to calculate membership fees, and work hard to keep them as low as possible. Your individual membership fee will be based on your membership details, which means your fee responds to how your practice changes over time.

See your Member Benefit Statement for your individual membership details for the current and three prior membership periods. The factors we consider in our calculation are:

- your category (eg General surgery; Dentist; Psychiatry)

- your practice basis (eg Employer indemnified; Recent graduate)

- your estimated annual gross billings and/or salary for practice that is not employer indemnified

- whether your type of practice requires an endorsement (eg Minor cosmetic services; Spinal surgery; Bariatric surgery)

- the state/territory you practise in

- your retroactive cover date

- any loadings including a risk surcharge. If applicable, the risk surcharge will be included in accordance with the ‘Medical Indemnity Act 2002 (Cth)’.

A minimum membership fee may apply.

Your membership fee is individually calculated based on the information you provide about the nature and length of your practice.

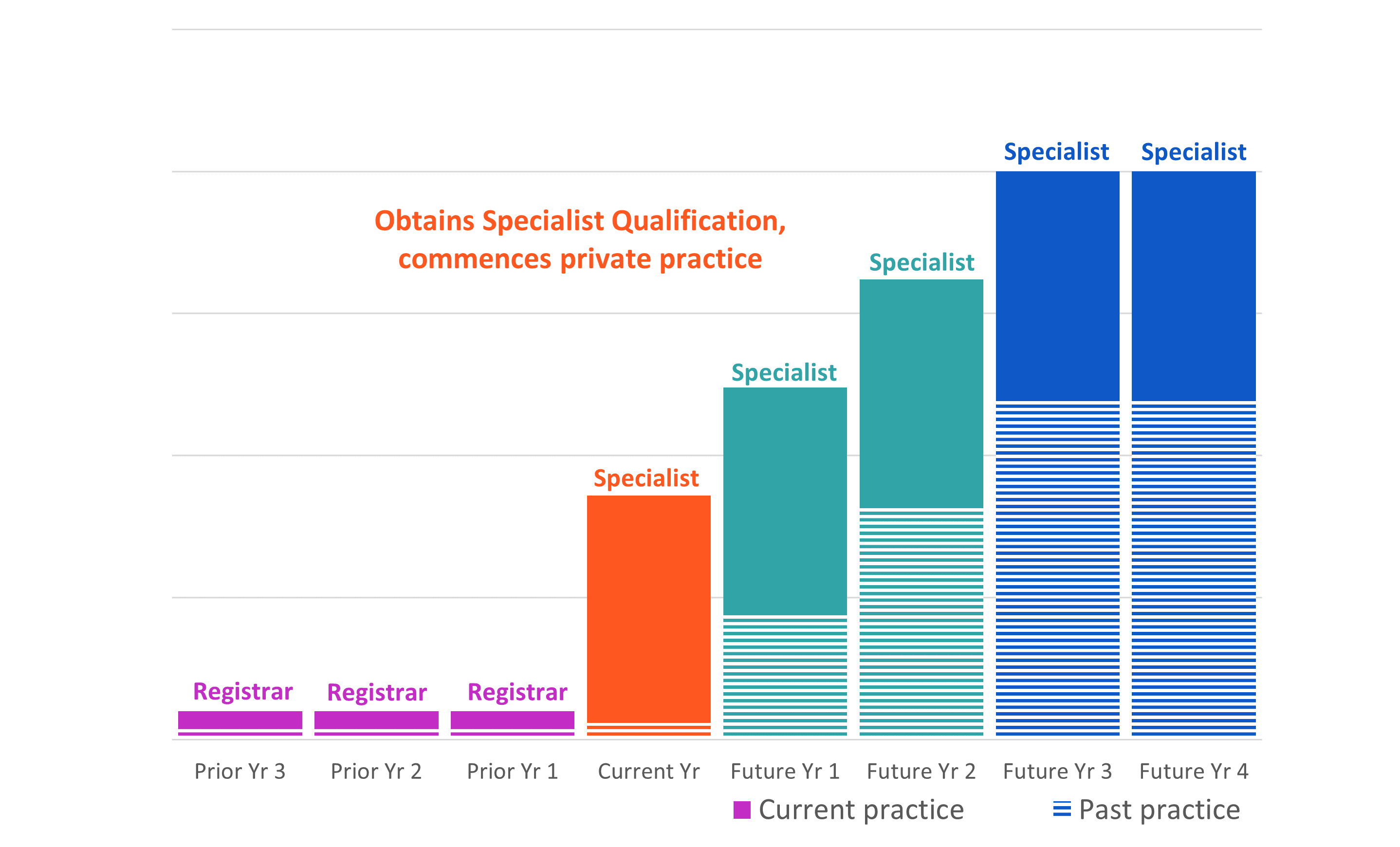

This approach ensures that your fee reflects the contribution required to appropriately support and cover the risk to indemnify you. As your practice changes and develops, so does your membership fee. If you have recently commenced practice that in not indemnified by your employer (or moved to a higher risk practice classification), your membership fee may change.

You can expect to see a stepped increase in your membership fee each subsequent membership period until you reach the ‘mature’ rate. If you move from a high-risk classification to a low-risk classification, the reverse will happen.

Reaching the mature annual fee

Each year, a stepped increase (or decrease) will be applied to your membership fee until your membership details reflect the same classification (and location) for the current and three prior membership periods, after which time you will pay the mature annual fee.

Does MIPS ‘price match’ or discount?

As a not-for profit- we believe that our risk assessment approach leads to member being charged with a fair membership fee.

On this basis, MIPS does not price match or discount as we charge what we have calculated as the appropriate contribution required to cover your member benefits including the risk arising from both current and past practice.

We recommend you contact MIPS to ensure your membership classification is appropriate for the practice you undertake. Any adjustments to your current or past practice details may result in an adjustment to your membership fee.

If you need to request a revised quote or require any assistance contact MIPS on 1800 061 113 or info@mips.com.au

Government support with fees

You may be eligible for the Australian Government’s Premium Support Scheme (PSS), which is designed to help eligible doctors with the costs of their medical indemnity insurance. For more details, visit our PSS page here.

The Australian Government also offers a Run-off Cover Scheme (ROCS) – see more information about this at the ROCS FAQ at health.gov.au or on our ROCS page here.

How to pay your membership fee

Your membership fee can be paid in full by the due date, or in 10 monthly direct debit instalments. To opt in for direct debit, complete the Direct Debit Instalment Request at mips.com.au/forms

Log in to pay your fee