Chairman's and CEO's report

To the Members of Medical Indemnity Protection Society Ltd (MIPS):

2019/20 was a challenging and uncertain year for MIPS, MIPS members and the entire community as the world has grappled with the impacts from the global health and economic crisis caused by the COVID-19 pandemic.

Support for members

MIPS has had members’ needs front of mind more so than usual. The global pandemic has materially impacted members. Some are unable to practice due to government restrictions, while others are managing a significant increase in workload. Many are working under greater personal and family stress.

MIPS’ purpose of ‘protection, support and advice from an MDO that understands your unique needs’ has given direction to our actions. MIPS has continued to support our members by:

- holding 2020/21 membership fees at the 2019/20 fee structure

- supporting members coming out of retirement to join Australian Health Practitioner Regulation Agency’s (AHPRA) pandemic response sub-register

- increasing staff numbers in our member facing teams to maintain high service levels

- extending cover to members who unknowingly transmitted COVID-19 while providing healthcare for their 2019/20 cover period

- reminding members to reflect on their current practice at membership renewal

- responding to the pandemic challenges with specific member risk education

- continuing to lobby for our members with relevant government and regulatory bodies.

Financial position

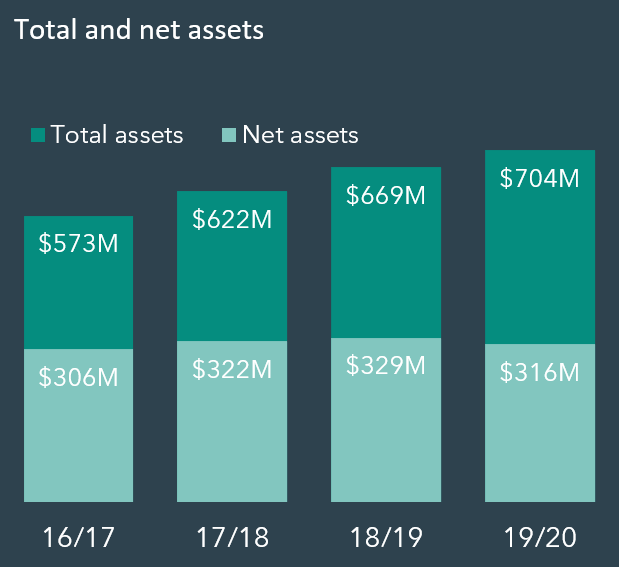

MIPS entered the COVID-19 crisis in a strong financial position and has used this strength to support our members. The challenging environment has contributed to MIPS Group’s total comprehensive loss of $12.71 million. However, MIPS’ financial position remains extremely sound with gross assets of $704 million and net assets of $316 million which will continue to support our members.

Within the MIPS Group, an improved claims performance has resulted in MIPS’ wholly owned subsidiary, MIPS Insurance Pty Ltd (MIPSi) reversing last year’s loss and recording a profit after tax of $1.6 million.

The net claims incurred improved significantly over the previous year with a favourable run off calculated by our Appointed Actuary, on prior years claims of $11.7 million.

To protect against uncertainty in the actuarial valuation, MIPSi has continued to maintain a higher level of prudential margin than that required by either accounting standards or Australian Prudential Regulatory Authority (APRA).

MIPSi continues to focus on prudently managing MIPS members’ funds including the preservation of capital to protect the interests of MIPS members. This focus underpins the setting and maintaining of the investment strategy, purchasing reinsurance coverage and maintaining sound underwriting and pricing practices. The investment result was an excellent outcome in view of low investment yields and the impact of COVID-19 on investment markets in the final quarter.

Once again, MIPSi’s capital adequacy ratio significantly exceeds both the minimum APRA Prudential Capital Requirement (PCR) ratio of one and the general industry average. As at 30 June 2020 MIPSi had a PCR ratio of 3.27. With a high PCR ratio, gross assets of $540 million and net assets of $153 million, MIPSi’s financial position remains extremely sound.

Operational resilience

MIPS has demonstrated operational resilience by continuing to deliver services to our members while prioritising the health and safety of MIPS people. COVID-19 has changed our ways of working and close to 100% of the MIPS team have been working remotely since late March 2020 delivering uninterrupted member services.

Governance

Good governance is central to MIPS Group; the boards, executive and all MIPS people acknowledge and support this. Three Board committees are tasked with monitoring performance in key areas of responsibility. The Group Audit and Compliance Committee and Group Risk Committee were both chaired by Norman Newbon until his retirement on 31 December 2019. Paul Kernaghan has been appointed in the role from January 2020. The Group Investment Committee was chaired by Kerry Roxburgh until his retirement on 30 June 2020. The new chairman from July 2020 is Charles Steadman. Merran Kelsall joined the MIPS board in July 2020 and has been appointed to the Group Investment Committee.

Our thanks to the retired chairmen and members of those committees for their contributions.

MIPS People

This financial year saw leadership changes with Natasha Anning joining as the CEO of MIPS in January 2020. She has been supported by the MIPS leadership team and all the MIPS team during this challenging period for MIPS members, its people and the community.

Thanks to all the MIPS Group Board members and the MIPS team for their focus on protecting, supporting and advising you, our members, during one of the most defining and challenging periods. We thank you for the confidence and trust you, our members have in MIPS.

Mr Gary Speck

Chairman

Ms Natasha Anning

CEO

23 September 2020

Access your copy of the MIPS Annual Report 2019/20

Should you have any queries relating to your membership please contact us on 1800 061 113 or info@mips.com.au

The materials provided are for educational purposes only. Whilst all reasonable care has been taken in preparing these materials, including the accuracy of the information supplied, MIPS does not accept any liability whatsoever arising out of the use or reliance of the information provided. Contact MIPS 24/7 Clinico-Legal Support 1800 061 113 or education@mips.com.au for specific advice.