Membership renewal 2022-23

Changes to member benefits

From 1 July 2022, some improvements have been made to the member benefits and are detailed in the Member Handbook. From 1 July the following key changes take effect:

- The Indemnity Insurance Policy (the Policy) has retained its limit unchanged at $20 million. A limit of $100,000 is being introduced for MIPS Assist claims. There were previously no limits for MIPS Assist and this limit exceeds the cost of all but a few claims. MIPS Assist is discretionary cover and is separate to the Policy that is also a benefit of membership.

- Updates to the policy section that refers to the assistance MIPS provides to members where they are accused of sexual assault, sexual harassment, sexual misconduct, bullying or discrimination in connection with their provision of healthcare to make the cover clearer. The intention remains the same and MIPS will continue to defend doctors until they are found guilty or admit to any of these offences. There is still no cover for criminal offences.

- Updates to the definition of healthcare to make it clearer that MIPS covers members performing non-clinical roles such as teaching or medico-legal work, which require AHPRA registration.

- Updates to the 'Minor cosmetic endorsement’ to list additional cosmetic procedures covered under this endorsement without the need to submit further information, for example, platelet rich plasma (PRP) injections (autologous only) for skin rejuvenation purposes (excluding genitalia) (medical practitioners only).

- Replaced the 'Specified procedures endorsement' for general dentists with 'Dental implants extension'. This means effective 1 July 2022 you no longer require an endorsement to perform multiple adjacent crowns, conscious sedation or high-risk procedures..

Renew membership now

Key covers remain the same

In the updated policy you will find the table below that lists cover relevant to the practice of healthcare. These changes maintain the same comprehensive cover MIPS provides and makes the terms of cover clearer and easier to understand. Importantly, MIPS has maintained the premium feature of not having any sub-limits for key covers.

Follow each link below to see the detail within the Indemnity Insurance Policy.

| Area of cover |

Sub-limit |

Aggregate limit |

| Insurance Cover Part A |

$20M |

| Civil liability coverage |

None |

| Appeals (under part A) |

None |

| Insurance Cover Part A – Extensions |

| Discipline and regulatory matters and hospital inquiries |

None |

| Mandatory reporting |

None |

| Medicare and PSR |

None |

| Private health investigations |

None |

| Coronial inquiry or royal commission |

None |

| Drug and poisons authorities |

None |

| Removal from proceedings |

None |

| Subpoenas |

None |

| Insurance Cover Part A – Specific inclusions |

| Indemnity dispute pursuit |

None |

| Telehealth |

None |

| Clinical trials and research projects |

None |

| Student placements and Healthcare activities |

None |

| Gratuitous services |

None |

| Medical retrievals and repatriation |

None |

| Good Samaritan acts |

None |

| Insurance Cover Part B – Extensions |

| HIV, Hepatitis B or Hepatitis C |

$25,000 |

| Insurance Cover Part C – Extensions |

| Administrative Staff or Assistants |

None |

| Sole practitioner entity |

None |

If you are not a sole practitioner you may need to consider a separate Practice Entity Policy to cover your practice entity and actions of your staff. MIPS has established a relationship with Aon to help MIPS members with queries and obtaining a quote for Practice entity, cyber and product & public liability coverage.

Claims experience and current trends

Over the last 12 months, MIPS has seen an increase in the volume of representational matters, in particular with AHPRA, Medicare and the Professional Services Review (PSR).

MIPS is also experiencing an increase in the damages component of claims costs with the average settlement increasing by more than 10% in the last 12 months.

Has your fee increased?

As a not-for-profit mutual, MIPS is committed to keeping fees low to provide ongoing indemnity and support to members. We have seen changes including inflation of business operating costs, an increase to the average cost to defend civil matters and higher numbers of matters where MIPS defends and assists members with notifications made to regulators such as AHPRA. This means that the cost of operating MIPS has increased, and this is reflected in all members’ fees. Fee increases are appropriately apportioned to ensure contribution from individual members is fair.

Other reasons why your fee may have changed:

- stepped increase towards the mature fee, where you may have recently commenced private practice, amended your gross billings, changed the type of practice undertaken or primary practice location

- paying a pro-rated fee if you joined MIPS during the membership period.

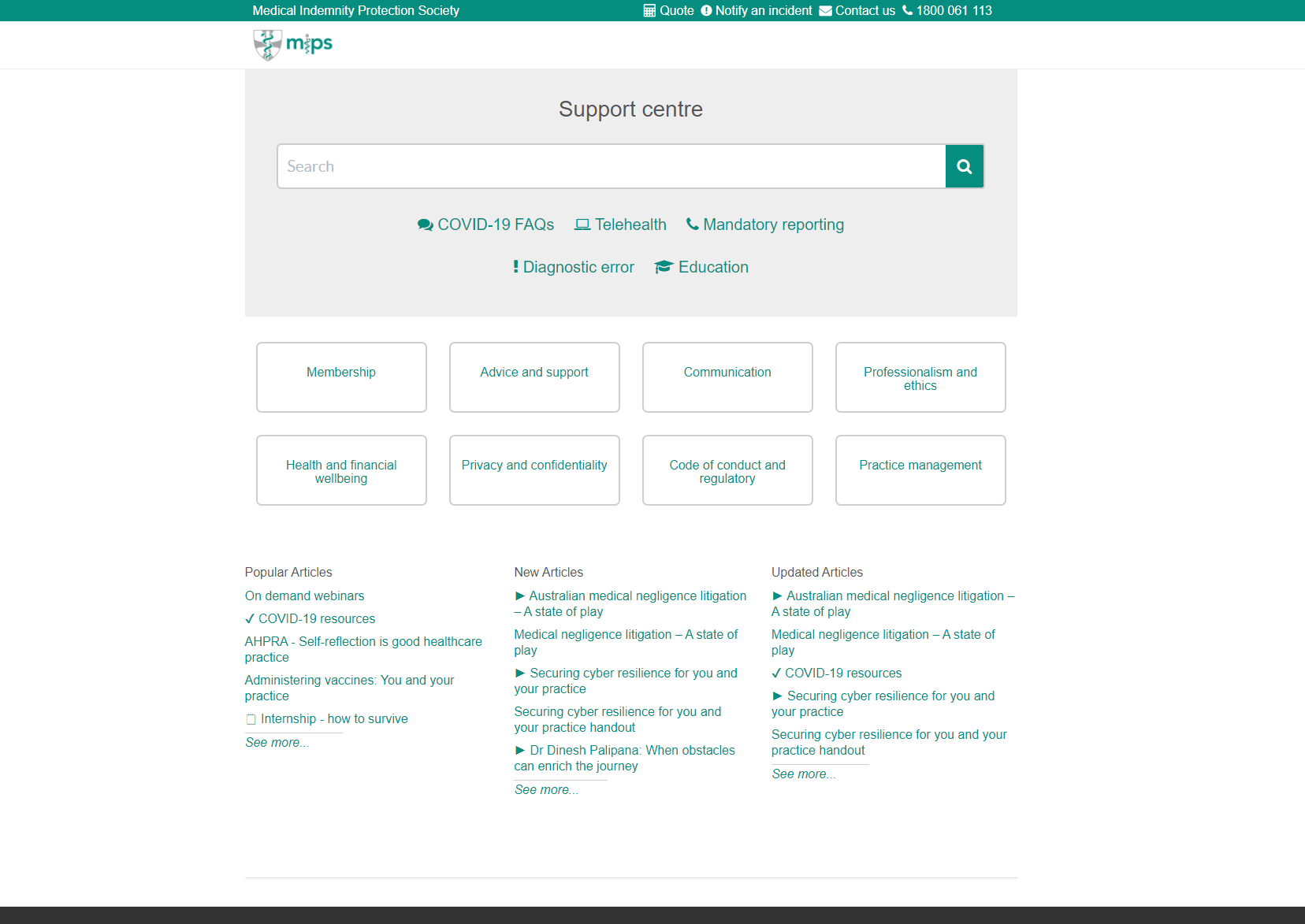

See our Support Centre

MIPS has been expanding its library of on-demand CPD available to members throughout the last year. This includes a variety of 1hr videos you can view and receive a certificate towards your CPD, as well as a range of practice notes to read. Search the Support Centre for topics such as COVID-19, mandatory reporting, consent, healthcare records and interview/CV/job applications.

The information provided is general advice only and does not take account of your personal circumstances or needs. You should review the Member Handbook Combined PDS and FSG and Target Market Determination before making a decision on whether MIPS is right for you. You can discuss your requirements with a Member Services Representative on 1800 061 113. Information is current as at the date published.