Malpractice insurance

MIPS membership includes indemnity insurance (ie malpractice insurance, professional indemnity) as part of the cover and support we provide to healthcare practitioners and students.

Healthcare professionals in clinical practice face significant risk of complaints, legal action and investigation. MIPS' indemnity insurance provides cover for up to $20 million with no sub-limits. This meets AHPRA’s mandatory requirements. Indemnity insurance provides civil liability cover, including defence costs, for claims arising out of acts, errors or omissions you make in providing healthcare.

Indemnity insurance for doctors, dentists, oral health professionals, nuclear medicine technologists and healthcare students is the main benefit of MIPS membership. See the Member Handbook for details.

- $20 million cover

- No standard excess

- No sub-limits within the $20 million cover

- Legal defence costs

- Civil liability/damages costs

You may also see this type of indemnity referred to as malpractice insurance, negligence insurance, professional indemnity, healthcare indemnity or professional liability insurance cover.

Understanding claims-made and medical indemnity insurance in Australia

Medical indemnity insurance in Australia is provided on a claims-made basis. This approach is different to some other countries, such as the UK where cover is generally provided on a claims-incurred basis. MIPS membership includes indemnity insurance with a claims made policy. Claims made is different to claims-incurred, which is how most insurance policies, such as your car or home contents insurance, are offered. MIPS membership and other claims made policies include a retro-active cover date which affects the cost.

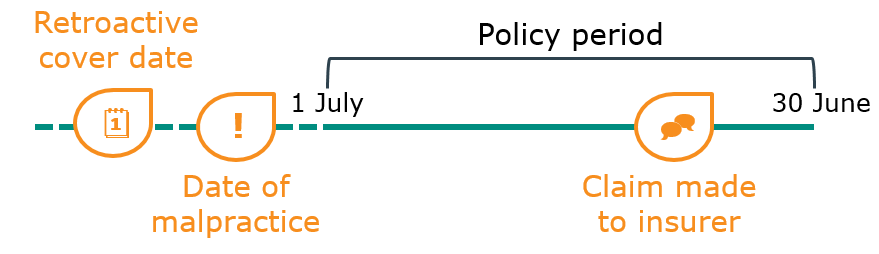

Claims-made insurance (MIPS indemnity)

Claim accepted. The claim occurs after the retroactive date and is reported within the period of insurance.

Claim accepted. The claim occurs after the retroactive date and is reported within the period of insurance.

This is how MIPS' insurance cover works.

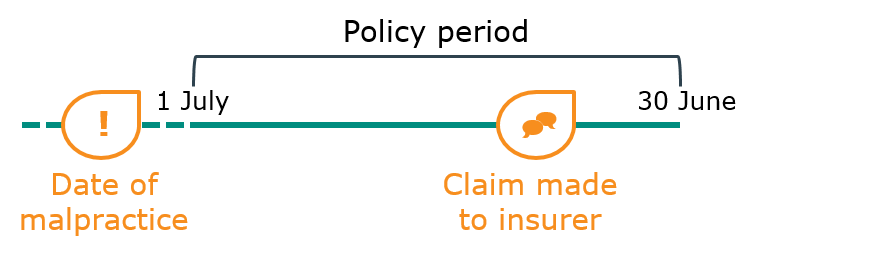

Claims-occurrence insurance (NOT MIPS indemnity)

Claim rejected. While the claim is made during the period of insurance, the incident occurred outside of the policy period.

Claim rejected. While the claim is made during the period of insurance, the incident occurred outside of the policy period.

This is NOT how MIPS insurance cover works.

Claim-made insurance policies cover claims made in the period of insurance and notified to the insurer in the period of insurance.

This means that MIPS members are only covered under the Indemnity Insurance Policy and the Practice Entity Policy if they are a member at the time the claim is made against them. Also, you are not covered for incidents prior to your retroactive date or previously known to you or matters that have been notified to you or your previous insurer or medical/dental defence organisation.

You must notify MIPS as soon as reasonably practicable after you first became aware a claim or investigation is made against you, in accordance with the terms and conditions of the policy.

To the extent provided in section 40(3) of the Insurance Contracts Act 1984 (Cwlth) where you give notice to an insurer of facts that might give rise to a claim as soon as was reasonably practicable after you become aware of those facts but before the policy period expires; you are covered for any claim made against you arising from those facts even if it is not made against you until after the policy period has expired.

If you are making a healthcare / medical indemnity insurance comparison consider Why MIPS is different and try to understand indemnity in detail.

Summary of recent history of medical indemnity in Australia

Indemnity insurance for doctors and dentists has typically been provided by Medical Defence Organisations (MDOs) such as MIPS. Nowadays it is a very stable industry with a small number of providers.

In 2002 there were significant concerns about the capital adequacy of indemnity insurers and the Government announced a number of measures. Later, a major reform legislated which included the Medical Indemnity Act 2002 (Cwlth) which forms the back-bone of the industry now. When this bill was introduced, insurers moved from claims-incurred models similar to house and car insurance contracts, to claims-made insurance contracts, which include retro-active cover. This provides better protection for both the healthcare practitioners and the community.

Universal Cover

Indemnity insurance cover is a mandatory requirement for Australian healthcare practitioners. Each state and territory has an insurance provider under Universal Cover for medical indemnity insurance to ensure every registered practitioner is able to obtain indemnity cover. In simple terms this means there is an insurer of last resort in each state and territory for practitioners that have been declined insurance cover from other providers. MIPS provides Universal Cover for the ACT and Tasmania. Universal Cover is only made available to members in extraordinary circumstances. Conditions apply. If you think your application will fall under Universal Cover arrangements, you can contact info@mips.com.au for more information.

What is professional indemnity insurance?

Or what is medical indemnity insurance, or what is dental indemnity insurance?

MIPS' indemnity insurance policy provides cover for any acts, errors or omissions you make in providing healthcare. This means that should there be a complaint, claim, investigation or legal action made against you, then you can notify MIPS. This includes being sued (ie litigation). The legal defence costs and any further costs such as damages you are required to pay due to a settlement or court order are paid by MIPS provided they fall within the scope of the policy.

More information on indemnity insurance policies